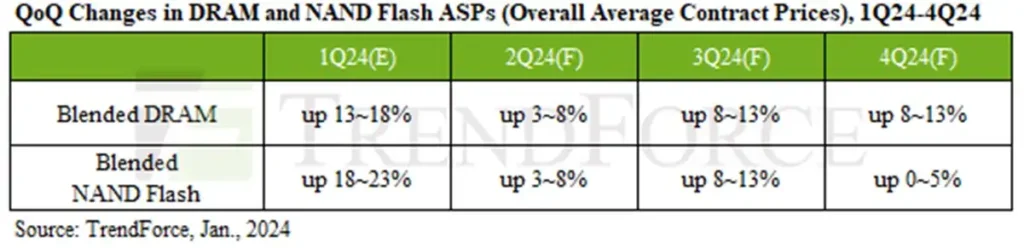

An in-depth analysis of the DRAM and flash market has unveiled a concerning trend of escalating prices in both commodities, potentially persisting throughout 2024. This surge in prices could reverberate across the tech industry, impacting the costs of memory modules and SSDs. TrendForce, a leading market research firm, first observed the price upswing in the spot market for DRAM and flash towards the end of the previous year. Having experienced two consecutive years of price decline since 2021, the market is now poised for a significant shift. Projections indicate a substantial increase in contract market prices for DRAM, ranging between 13 to 18 percent in the first quarter alone, accompanied by expected hikes for NAND flash between 18 to 23 percent.

The spot market, analogous to a “grocery store” for electronic components, plays a pivotal role in gauging market dynamics. Large bulk orders placed by module makers or SSD manufacturers on the spot market set the tone for contract prices—the predominant arena for DRAM and flash transactions. Industry insiders are now witnessing buyers locking in higher prices, reflecting their belief in the evolving pricing dynamics of these critical components. While TrendForce anticipates a restocking phase for NAND flash buyers by the first quarter, leading to a potential drop in contract prices, the forecast hints at more moderate increases throughout the year, ranging between 3 to 8 percent in the second quarter.

The DRAM market, on the other hand, is expected to exhibit smaller yet consistent gains over the entire year. This trend is attributed, in part, to the increasing prevalence of DDR5 memory, contributing to an overall uptick in average prices. However, amid these projections lies a historical complexity—market dynamics influenced by elements akin to oil cartels. The delicate balance of production volumes and capacity utilization plays a pivotal role. With memory manufacturing capacity still below full utilization, there exists a risk of overzealous production increases leading to a supply surplus, subsequently causing prices to decline. While such a scenario is not currently anticipated, the industry remains watchful of potential shifts that could impact the delicate equilibrium.