Bitcoin and blockchain are on everyone’s lips, but for many people they are a closed book. We try to explain the most important terms as clearly as possible.

Bitcoin and blockchain are on everyone’s lips, but for many people they are a closed book. The topic is indeed complex. We’ll try to explain the most important terms as clearly as possible.

Bitcoin (BTC) is a digital currency. The name is a combination of bit (smallest binary unit of information) and coin. The quantity is limited to 21 million and 19.5 million of these have already been mined or generated.

However, as the amount of BTC distributed decreases over the years, it will be more than a hundred years before the last Bitcoin is mined. The smallest unit of Bitcoin is a Satoshi – 0.00000001 BTC. Theoretically, it could be scaled infinitely smaller, but this would only make sense if a BTC were worth much more. For a Satoshi to be worth one dollar, a Bitcoin would have to cost 100 million dollars (as of the end of 2023 it was approx. 41,000 dollars).

There are no exact figures, but experts assume that 20 percent of all Bitcoins mined to date are lost forever. This is due to user error, lost keys, technical glitches, hacks, and theft. The founder of Bitcoin alone (with the pseudonym Satoshi Nakamoto) is said to have owned over 1.1 million BTC, which are allegedly no longer accessible.

Satoshi Nakamoto published the white paper on Bitcoin on October 31, 2008. His last message was dated December 12, 2010, but it is still unknown who is behind the name. There is speculation that the BTC founder has passed away.

What is a blockchain?

One crucial point is that the Bitcoin network does not belong to anyone. It is completely decentralized (P2P) and open source: anyone can join in. A core team takes care of the further development of the software.

If you want to understand Bitcoin better, you need to know what a blockchain does. Blockchain is a technology that works like a public ledger. It records every transaction that has been made. This applies to bitcoins as well as other cryptocurrencies.

Each page in this ledger is a block in which a certain number of transactions are recorded. When such a block is full, it is appended to the chain in chronological order. The blocks are linked together using complex mathematical algorithms and the chain is therefore very secure.

In the case of Bitcoin, the blockchain is decentralized. It is therefore not stored in one place, but is distributed across many networked computers (nodes or network nodes). As a result, no single person or group has control over it.

Ledger

Full nodes and light nodes: There are several types of nodes and the most important are the so-called full nodes. They contain a complete copy of the blockchain and also validate it. The entire transaction history is therefore permanently stored on these network nodes.

The tasks of the full nodes are also subdivided again. Some of them archive the blockchain permanently, some validate it and others discard the oldest blocks to save space (pruned nodes). Some full nodes also mine new blocks (mining nodes).

The various forms of full nodes have very different hardware requirements. While an archive can run on a Raspberry Pi, the tiny device is not suitable for mining due to its lack of computing power.

Light nodes (also known as SPV nodes, Simple Payment Verification) consume hardly any resources and are often used in wallets (purses). They communicate with the blockchain for transactions and rely on the full nodes.

Mining: Blockchain mining is a metaphor for the computational work that the nodes perform to validate the information contained in the blocks. In reality, mining is more like checking blocks. The miners verify the legitimacy of Bitcoin transactions and receive a reward for doing so.

Trending for you

- Best laptops 2024: Premium laptops, budget laptops, 2-in-1s, and more

- Best Thunderbolt docks 2024: Extend your laptop’s capabilities

- Best VPN services 2024: Top picks for speed, price, privacy, and more

To mine a block, computers have to solve complex tasks. Whoever solves the task receives the reward for the respective block.

IDG

An algorithm adjusts the difficulty of the task so that a block is mined approximately every 10 minutes. The more computers in the network compete for the block rewards, the higher the total computing power, the so-called hash rate, and the higher the difficulty.

This type of mining is also known as PoW (Proof of Work). Other blockchains, such as Ethereum 2.0, use a PoS (Proof of Stake) consensus, which consumes much less energy but is considered less secure.

Halving: The very first block (Genesis Block) was mined on January 3, 2009, and the reward at that time was 50 BTC. An algorithm ensures that a so-called halving occurs approximately every four years. This halves the amount of BTC distributed per block. In 2012, there were therefore only 25 BTC per block. In 2016, 12.5 BTC was distributed per block and since 2020 there has only been 6.25 BTC as a reward. The next halving is expected in mid-April 2024, after which there will only be 3.125 BTC per block. The supply will therefore be artificially limited.

Wallets

You can compare a wallet to a physical wallet. However, instead of paper money, bitcoins or other cryptocurrencies are stored in it. The most important data in a wallet is

- The public key: This is effectively the account number or address of your wallet. You can share these addresses with other people so that they can send you bitcoins or other cryptocurrencies.

- The private key: You guard this key like the apple of your eye because it is the access key to your bitcoins.

Many wallets offer an additional recovery function when they are set up, which you should definitely use. Keep the recovery options and your private key safe and make sure that nobody can access them.

Cold and hot wallets: When it comes to wallets, there is a distinction between hot wallets and cold wallets. A hot wallet is a wallet that is always connected to the internet and the blockchain. Bitcoins are usually sent via hot wallets.

A cold wallet, on the other hand, stores the bitcoins securely, almost like a vault. They are also known as cold storage. Cold wallets remain offline. This protects the wallet from cyberattacks and other vulnerabilities. Owners of considerable amounts of Bitcoin will always divide them up so that only a small proportion is stored in a hot wallet and the rest is well protected in a cold wallet.

Creating a cold wallet

There are several ways to implement a cold wallet, with some options being a hybrid solution. A very secure method is a hardware wallet such as Ledger (approx. 80 dollars). However, it is relatively complicated to use as soon as you want to spend bitcoins. Simply scanning a QR code is usually impossible. If you want to spend bitcoins, you must first transfer them from the cold wallet to a hot wallet. However, a hardware wallet is perfect for long-term investments.

Alternatively, you could set up an operating system in a virtual machine and set up your wallet in it. Then write down the public BTC address, disconnect the virtual machine, and back it up. Now you can transfer bitcoins there and they will be stored securely.

IDG

The Linux distribution Tails has the Bitcoin wallet Electrum pre-installed. This option is similar to the virtual machine solution. You set up the Tails system on a USB stick and create a wallet there. You then clone the USB stick or back it up in some other way and store it securely.

A paper wallet used to be a popular method. The address and private key are written on a piece of paper. There are paper wallet generators on the internet, but there are also malicious ones. It is now strongly discouraged to create a paper wallet online, as these websites could intercept the private key. Such wallets are therefore now viewed very critically. If you still want to use a paper solution, it is probably safer to create a wallet with a system such as Tails and then write down the private keys by hand.

Popular hot wallets

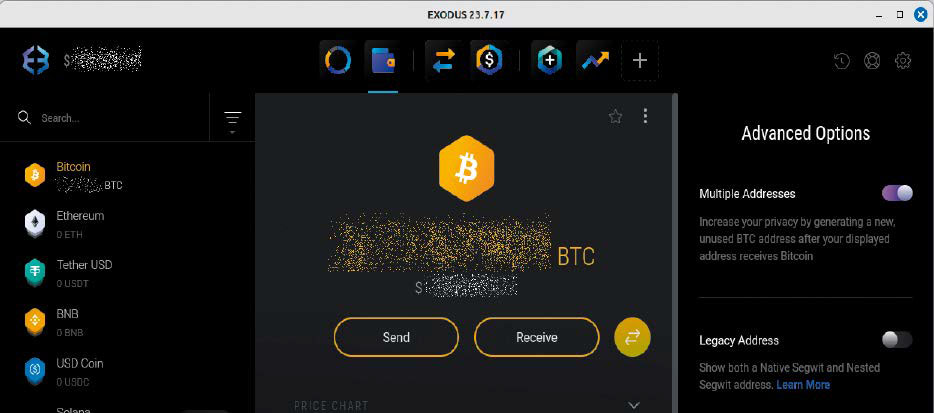

There are many crypto wallets and most of them support multiple cryptocurrencies. Nowadays, many wallets are user-friendly and are also suitable for the less tech-savvy. Some wallets, such as Exodus, are available for both desktop and mobile devices. Since it is often difficult and cumbersome to scan QR codes with desktop wallets, smartphones are usually better suited as a hot wallet.

IDG

One of the most flexible Bitcoin wallets is Electrum. Admittedly, it’s not the prettiest digital wallet, but it is flexible and secure. One disadvantage of Electrum is that the software only supports Bitcoin. There are offshoots for other cryptocurrencies, but the original only supports BTC. However, this can also be an advantage.

At https://bitcoin.org you will find a guide that can help you choose a wallet. If in doubt and for larger amounts, it is best to stick to the reputable providers.

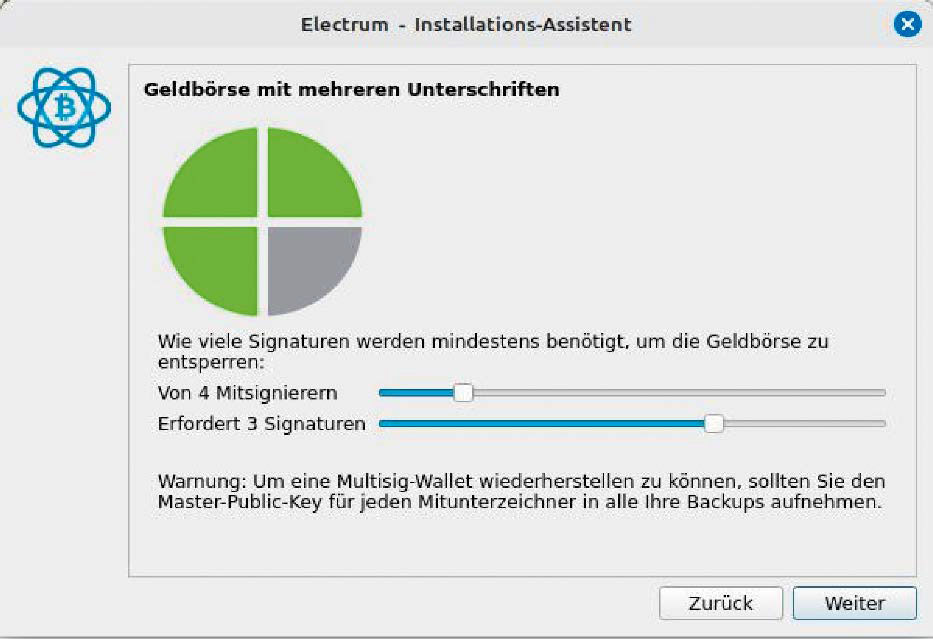

What are multisig wallets?

Developers are increasingly focussing on the maximum secure storage of bitcoins. This is why there are now also multisig wallets, also known as multisig safes. This is a crypto wallet that requires several private keys to perform certain tasks. Of course, this significantly increases security, but it also increases complexity. A multisig wallet requires the signature of several predetermined addresses in order to carry out a transaction. If a signature is missing, no transaction is possible.

This complexity makes sense if, for example, more than one person in a company has to authorize BTC transactions. Whether multisig is necessary for individuals depends on their personal sense of security and the amount of BTC.

Efforts are being made to make complex multisig more user-friendly. One wallet with multisig support is the aforementioned Electrum app. An alternative to this would be Sparrow, which is aimed at advanced users but is still user-friendly.

Caution! Multisig is more secure, but you cannot lose a single key, otherwise you will no longer be able to access the funds. This means that a backup becomes much more complex: Because if you keep all your keys in the same place, multisig doesn’t really make sense.

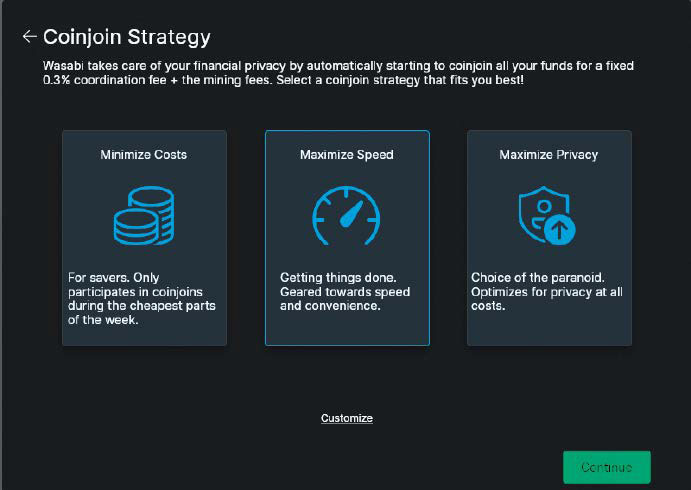

Wallets with Coinjoin

IDG

There are also non-custodial wallets such as Wasabi, where coinjoin is integrated. A coinjoin is a joint transaction between several senders. Coinjoin means that you find another person who also wants to carry out a transaction. You then carry out the transaction together at a lower cost.

Coinjoins make it much more difficult to track transactions. This is why it is recommended to regularly disguise your funds in this way. On the other hand, you need to be careful here, because some recipients no longer accept BTC that has passed through a coinjoin for regulatory reasons.

The Lightning network

One of the biggest problems with Bitcoin is its scalability. Theoretically, 10 TPS (transactions per second) are possible with BTC, but in practice even less.

For comparison: Visa probably manages an average of 6,000 TPS. This is why the Lightning network was developed. With Lightning, two parties open a channel and exchange funds directly with each other. Once all transactions have been completed, the process is transferred to the Bitcoin network. In theory, there are no longer any limits to the TPS. In practice, only the user’s hardware is a limiting factor.

Another advantage of Lightning is that the fees are more favorable, which is particularly important for small amounts. Lightning transactions also consume significantly less energy. Only the opening and closing of channels is recorded in the blockchain. The intermediate transactions are only known to the parties involved, which in turn is advantageous for privacy.

Buying bitcoins

As mining bitcoins is usually not worthwhile for an individual, you have to buy them. There are crypto exchanges or exchanges for this purpose. You transfer money there via SEPA and then buy bitcoins. At least that is the cheapest option. You need to make sure that you can also transfer your funds to your own wallet.

This is possible with Revolut, Bitstamp, and Crypto.com, but not with eToro.

There is a saying in the crypto community: “Not your keys, not your coins!” (not your private keys, not your coins). Anyone who has been the victim of a hacked crypto exchange or a collapse like that of the FTX trading platform can tell you a thing or two about this.

There are also trustworthy providers where you can buy bitcoins with a credit card. However, the fees here are usually very high and a critical comparison is highly recommended. From our own experience, a SEPA transfer to an exchange registered in Europe is the most favorable option. For most trustworthy crypto exchanges, “KYC” (Know Your Customer) is now mandatory. This means that you have to prove your identity in order to buy bitcoins.

Bitcoin – not anonymous, but pseudonymous

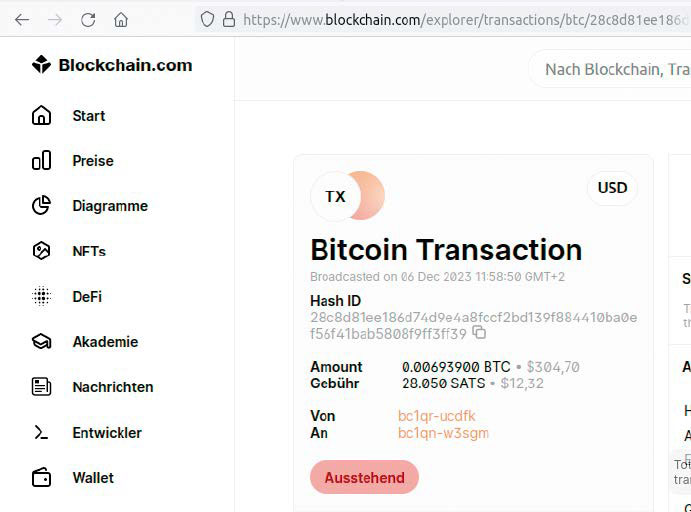

IDG

It is often assumed that Bitcoin transactions are anonymous. This is not true. The correct term should be Bitcoin is pseudonymous. The transactions themselves are publicly visible and can be tracked using a special explorer.

Although you cannot see who has transferred money to whom, the amount and the public addresses can be viewed. Sooner or later, with patience and sufficient data, you will be able to see which people have exchanged payment methods.

For example, if you buy bitcoins from a crypto exchange and then transfer them to your own wallet and use them to make purchases, it is theoretically possible to trace who you are. The aforementioned coinjoin provides a remedy, but has other disadvantages.

Where can I shop with bitcoins?

At https://btcmap.org/ there is a map with shops that accept bitcoins as a means of payment. However, these entries are made by volunteers. It is therefore quite possible that the map is incomplete or incorrect.

There are also websites such as www.bitrefill.com where you can purchase vouchers for cryptocurrencies. Well-known names such as Amazon, Saturn, or Zalando are represented here, as are well-known telephone providers.

It’s a little more complicated, but you can get surprisingly far with voucher websites and bitcoins. If you shop there with Bitcoin, you even get cashback in BTC. Proponents of cryptocurrency argue that with BTC you can provide millions of people with an account who have a smartphone but no access to a bank.

Criticized for energy consumption

Bitcoin’s high energy consumption is often criticized. Bitcoin supporters emphasize that cryptocurrencies promote innovation in renewable energies and will make redundant millions of ATMs, which themselves consume considerable amounts of electricity.

Electricity producers also mine with surplus energy that is not currently needed and would otherwise simply be diverted. According to a number of studies, BTC mining already uses over 50 percent renewable energy — and the trend is rising.

But yes: Other studies claim the exact opposite and that would indeed be harmful to the environment.